Forbes recently made a bold prediction that healthcare in 2020 would be “business as usual”. While many basic business fundamentals continue, the only constant throughout healthcare continues to be change. As Forbes predicts, in many healthcare sectors, provider costs are rising, physician burnout is increasing and patient satisfaction has declined. However it should be noted that there continues to be significant fuel propelling healthcare, and associated merger and acquisition activities, in the year ahead.

- Healthcare spending is nearing $4 trillion per year in America

- Increased health spending, year-over-year expected to climb 5.5% through 2027

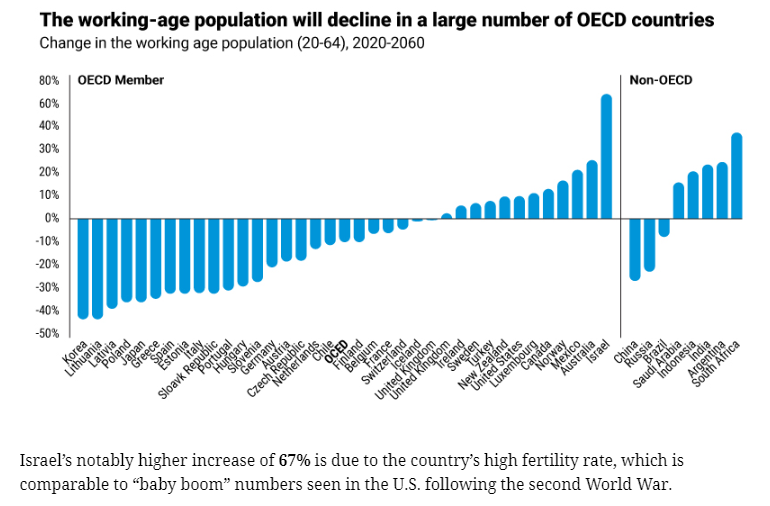

- An aging American population that sees 10,000 baby boomers per day turn 65

The consensus among most healthcare buyers and investors is that their M&A activities ahead will be well planned, strategic, and anything but usual, as they search for prime acquisition opportunities.

The depth and breadth of the healthcare business acquisition appetite is astounding. While news-making, market-moving transactions will continue to dominate headlines, the smaller, mid-market businesses are really the story here (PV Market Pulse). Increasingly, boomer era business owners are planning their exit and retirement, while others are capitalizing on strategic market opportunities. There is an equally motivated generation executing on the acquisition side for the next era of healthcare business growth and development. In common, both buyers and sellers will find successful M&A activities in the year ahead to be focused on sound, executable strategies. As always, business owners will need to carefully explore all their strategic options in a proactive, well prepared and confidential process.

The depth and breadth of the healthcare business acquisition appetite is astounding. While news-making, market-moving transactions will continue to dominate headlines, the smaller, mid-market businesses are really the story here (PV Market Pulse). Increasingly, boomer era business owners are planning their exit and retirement, while others are capitalizing on strategic market opportunities. There is an equally motivated generation executing on the acquisition side for the next era of healthcare business growth and development. In common, both buyers and sellers will find successful M&A activities in the year ahead to be focused on sound, executable strategies. As always, business owners will need to carefully explore all their strategic options in a proactive, well prepared and confidential process.

In this new decade, technology will continue to expand even more dramatically, in quantum leaps, throughout healthcare. This fact alone is motivation for some buyers to make strategic investments with significant opportunities to grow and improve overall profitability. Technology is in itself fueling the growth of many healthcare demographics. New clinical pathways, population health initiatives, quantum sensors, advanced pharma and innovative treatments are all leading to longer lifespans and market expansion.

The healthcare M&A market in 2020 is very well capitalized. Corporate buyers and private equity investors are sitting on over $100 billion in cumulative investment dollars which is specifically targeted for healthcare M&A in the year ahead.

For profitable, strong and growing healthcare businesses, their strategic options ahead in 2020 are plentiful. This includes complete exits, mergers and recapitalization. To succeed, your stakeholders and the business will need to be properly prepared. This includes all key areas including financial reporting, operations, regulatory compliance and human resources. A professional and experienced M&A advisory is critical in the sale process among an expanding, and diverse, buyer pool. Just don’t be surprised if your ultimate corporate buyer or private equity partner is not the usual suspects from years past. The players and their strategies have also evolved.

M&A SWOT HEADLINES

Strengths: Healthcare continues its necessary evolution as technology drives better outcomes, lowers costs and enables businesses to scale to unprecedented levels. Synergistic opportunities are also fueling business growth across previously divergent sectors. This is also driving M&A activity and fueling new buyer and investor focus.

Weaknesses: Rising costs and labor shortages. Regulatory and compliance demands. Disruptive advancements requiring cost management, business refinement and potentially new directions.

Opportunities: Diversification and scale. While not for the faint of heart (sic) the complexities of extending care amid rapidly changing regulatory demands provides barriers to entry. These barriers, while daunting to the novice, continue to drive opportunities for well established, market driven organizations. Large providers continue to see the value of population health initiatives including scaling operations across the continuum of care.

Threats: Third party payors. Reimbursement pressures continue to be a concern for providers drive the need for operating efficiencies amid declining profit margins. Disruptive initiatives will continue to threaten the status quo but also provide opportunities for those that are able to embrace them. A day of reckoning in some sectors with flat or declining margins and increasing labor costs.

- In 2020, I believe that every M&A transaction will be backed and propelled by one key and measurable factor, a well planned and executable strategy.

- With $1.4 trillion on tap in invest-able capital from corporate and private equity investors, healthcare will be a major M&A focus in 2020. The pace in 2020 shows no signs of retraction.

- Buyers and investors will continue to pursue unique and unprecedented transactions – many of them crossing sectors in the continuum of care. After years of steady industry consolidation, many of this year’s most transformative deals no longer take place between providers. Instead, non-traditional pairings—such as provider/pharmacy, provider/insurer, and multiple large companies are becoming more common.

- Technology will continue to drive innovation. Demand will continue to drive opportunity. Financial performance and accurate reporting will remain the key to valuation. Regulatory compliance will be hurdles every provider will need to deal with.

- Biggest challenges in 2020 – hiring people to fulfill their labor needs. Use of technology to bridge the gap.

- Tight Labor markets will impact health care mergers and acquisitions in the new decade 2020’s. With unemployment at 50 year lows and wages rising the fastest in decades, health care companies, especially those with high numbers of trained professionals, i.e. nurses, therapists, pharmacists, technicians of all types, even physicians, will feel the squeeze of labor costs on their bottom lines.

- As a full service advisory, we must be cognizant of these threats to profitability and more importantly, the ability to provide quality care and service to patients. The only way to solve this problem in the short term is to develop more efficiencies in operations, revenue cycle management and worker productivity (including tele-medicine), and to consolidate as an industry to best utilize the limited human resources available. Paragon Ventures can be a resource for business owners facing these challenges now and in the future.

- The start of a new decade in 2020 will continue to provide favorable exit opportunities for healthcare business owners. The strong economy of 2019 is expected to continue into 2020 with both private equity and strategic buyers equipped with the funds to close acquisitions.

- The consolidation activities of 2019 in many healthcare sectors, including behavioral health, HME & home health, are expected to remain strong into the new year. As M&A markets tend to ebb and flow, companies considering the sale of their business should seriously consider 2020 as their year to exit.

- Market timing is critical for business owners deciding when is that “right time” to sell.

- Company owners with 20+ years of business building will examine options, especially exiting when they are at the top of their game. It’s time to enjoy success and shift responsibility to a younger, more tech savvy generation of CEO’s.

- Business owners will turn to advisory firms to seek accurate valuations and examine exit strategies with a much more serious attitude.

- A strong emphasis will be placed on accurate financial statements. A feel good attitude will be backed up by profitable financials in order to maximize proceeds from the sale of a business.

- Changes in reimbursement will continue to impact valuation.

- I was honored and humbled to help celebrate Paragon Venture’s 25th year in healthcare M&A. It has been a magnificent ride so far, and I treasure my role at this company! My goal for 2020 is to bring on many more new clients for our team to represent in the marketplace, and bring all of our clients to successful closings.

- Each sector of healthcare will continue to face its own set of challenges to survive and thrive e.g. adding in elements of AI to increase efficiency & accuracy.

- Consolidation in many healthcare sectors continues and business owners have many strategic options, including options for management to stay on or move on, depending on their personal preferences.

- My number one goal is to cultivate meaningful relationships and provide valuable information to our clients and potential clients. I want to ensure they are aware of recent market activity, trends, new regulations and most importantly, their strategic M&A options.

- The coming decade will yield huge opportunities for business owners as 2019 has provided a springboard for consistently strong sectors as well as many previously challenged healthcare sectors. Business owners will need to stay on top of their financials and where their company fits into the marketplace.

- In the long term, working with a mergers and acquisitions broker can provide the business owner with insight into new opportunities of growth, new technologies being developed, as well as providing a true picture of where the business is in relation to similar companies in the marketplace.

- This insight will provide the owner with the necessary tools to make important decisions including when is the right time to sell the company.

- After a strong 2019, expect more of the same in 2020. The move towards overall home based care will continue to drive the market as providers look to find new ways to meet patient preferences.

- The desire for providers to offer the care their patients prefer while fending off an influx of atypical organizations looking for a piece of the pie will create some new and exciting challenges for dealmakers.

- Amazon is, as always, looking to be the biggest of these atypical providers, lowering prices and driving the market no matter what industry they enter. Dealmakers looking to capitalize in 2020 would be wise to stick with the baby boomers as some ten thousand retire each day. Paragon Ventures is on the forefront of the opportunities and would love discuss your strategic options.

- Have a happy, healthy and prosperous 2020.

For more information on M&A opportunities for your healthcare business, click here or call us at 800-719-1555